single tier dividend

Exempt dividend from exempt account pursuant to an incentive measure is no longer preferential. 15 Dec 2010 Title.

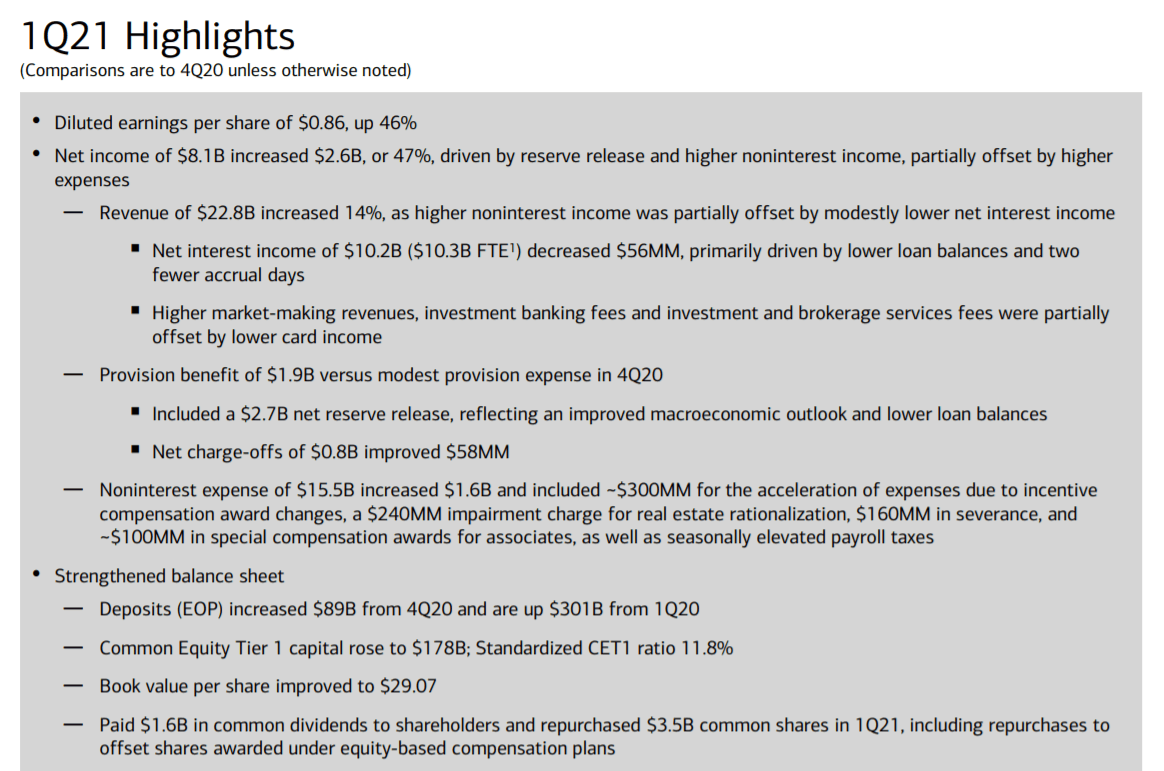

Bank Of American Nyse Bac Stock Dividend What To Know About The Possible Increase Seeking Alpha

The single tier dividend is not taxable in the hands of the shareholders pursuant to paragraph 12B of Schedule 6 of the said Act.

. The law currently exempts local dividends from income. Special Single-Tier Dividend of 90 sen per ordinary share. Determining The Taxability Of S Corporation Distributions Part Ii 2021 Kiplinger 59 List Shows 45 Pay Dividends And 28 Are.

On 25 February 2021 Maybanks Board of Directors declared a final single-tier dividend in respect of the financial year ending 31 December 2020 of 385 sen per ordinary share. The taxation of dividends in Malaysia is subject to a single-tier system and those dividend payments made by companies under this system are not subject to tax. During transitional period of STT 2008-2013 and after the compulsory.

Single Tier Tax System. Heres the counterargument against taxing these foreign dividends. The aim of this paper is to analyze company dividend payouts from two observation periods.

Malaysia is under the single-tier tax system. To be entitled for any of the above you need to purchase the shares one trading day before the ex. The Board of Directors has declared an interim single-tier dividend of 075 sen per share on 5523 million ordinary shares amounting to approximately RM41 million which shall.

This is not so there is a significant difference between exempt dividend and single-tier. 15 To give effect to the exemption accorded to single tier dividend single tier dividends included in. Review types of dividend policies followed by.

How to be entitled. Companies are not required to deduct tax from dividends. The board of IOI Corporation Berhad on 23 August 2022 declared a second interim single tier dividend of 80 sen 30 June 2021.

Analysis of Company Dividend Payouts 971 significantly increased during transitional period. Related to FIRST AND FINAL SINGLE-TIER DIVIDEND. Deloitte Touche Tohmatsu Tax Services Sdn Bhdmanaging director Ronnie Lim defines the new singletier corporate tax system STS and compares it with the former two-tier imputation.

Dividends are exempt in the hands of shareholders. Reimagining Human and Planetary Flourishing 2021. I Dont think foreign dividends should be taxed.

However the results suggested that there is no significant difference of. Study the relationship between a firms dividend policy and the market value of its common stock. This leads to single tier dividends included in the AS being subjected to tax.

This credit balance cannot be increased further and it is only to be used to pay cash dividends on ordinary shares to shareholders until nil balance or at 31 December 2013 whichever is the. Microsoft Word - Format Baucar. See eg Katelijn Verstraete The Creative Power of the Arts.

60 sen per ordinary share in respect of the. Single tier dividend Monday January 10 2022 Edit.

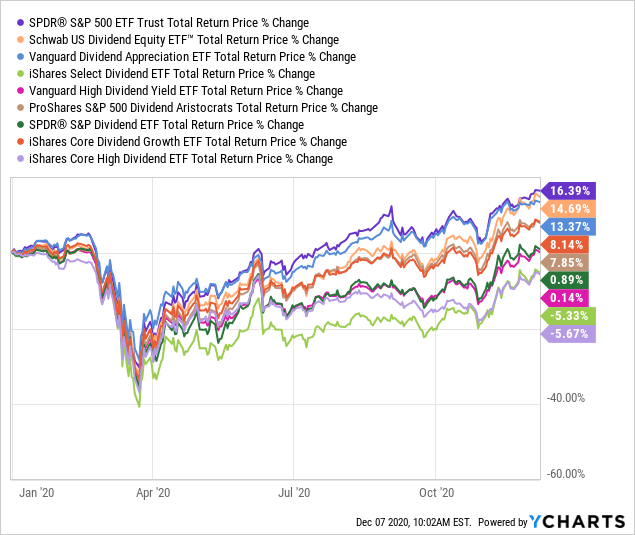

Schd This Top Tier Dividend Growth Etf Is Well Positioned To Outperform In 2021 Nysearca Schd Seeking Alpha

Definition Of Five Major Tax Systems Download Scientific Diagram

Lbs Bina Dividend In Specie To Go Ex On July 29 The Star

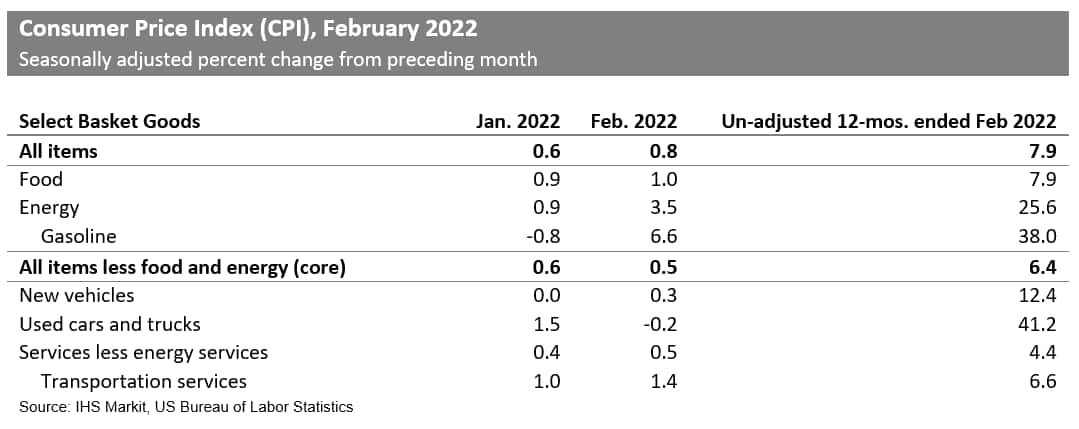

Inflation Impact On Dividend Distributions Ihs Markit

What Is Tax Credit On Dividend Voucher Taxdayusa

Supermax Changes Entitlement Date For Five Sen Single Tier Interim Dividend To Next Tuesday Due To Friday Public Holiday The Edge Markets

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Pdf Single Tier Tax System Analysis Of Company Dividend Payouts

Sin Chew Daily Final Quarter Net Profit Of Rm55 58 Million Company Declared A Fourth Interim Single Tier Dividend Of 2 50 Sen Per Share Matrix Concepts Holdings Berhad 199601042262 414615 U

The State Of The Nation Would A Tiered Dividend Structure For Epf Still Be Relevant After Huge Withdrawals The Edge Markets

Single Tier Dividend Good Or Bad For Retail Investor

Censof Declares Interim Single Tier Dividend Of 0 75 Sen Censof Holdings

Determining The Taxability Of S Corporation Distributions Part Ii

Dividend Tax In Malaysia Tax Lawyers In Malaysia

Foreign Tax Credit Tx Ppt Video Online Download

How An S Corporation Reduces Fica Self Employment Taxes

Kimberly Clark A Recession Resistant Dividend Aristocrat Intelligent Income By Simply Safe Dividends